The femtech boom: Startups serving women's health

In this post, we analyze a segment of companies that are on the upswing and have made the BioRegion the third leading European hub in number of femtech startups. Furthermore, according to women entrepreneurs and some investment funds, it could become one of the most profitable sectors in the short term as long as it secures one of its main challenges: funding

Women account for half the planet's population, yet women’s health has attracted little attention in terms of medical research and technological advances. This trend began to shift in 2016, when the Danish researcher Ida Tin, co-founder of the app Clue to track menstruation, defined the term femtech to refer to technology startups that create healthcare products focusing on women. The innovative new solutions include devices, software and diagnostics, technologies and services focused on responding to problems primarily related to pregnancy and nursing, fertility, sexuality and cancer prevention treatments. Even though many of these companies have emerged from personal experiences, the term femtech should not be confused with companies led exclusively by women entrepreneurs.

“Women have been invisible to medicine for many years. Femtech can reverse this invisibility and thus offer equal opportunities in healthcare,” says Marina Rigau, CEO and co-founder of MiMARK, which focuses on diagnosing endometrial cancer and is one of the latest femtechs established in the BioRegion.

In this post, we analyze a segment of companies that are on the upswing and have made the BioRegion the third leading European hub in number of femtech startups. Furthermore, according to women entrepreneurs and some investment funds, it could become one of the most profitable sectors in the short term as long as it secures one of its main challenges: funding.

COVID and feminism: The impetus behind the rise in femtech

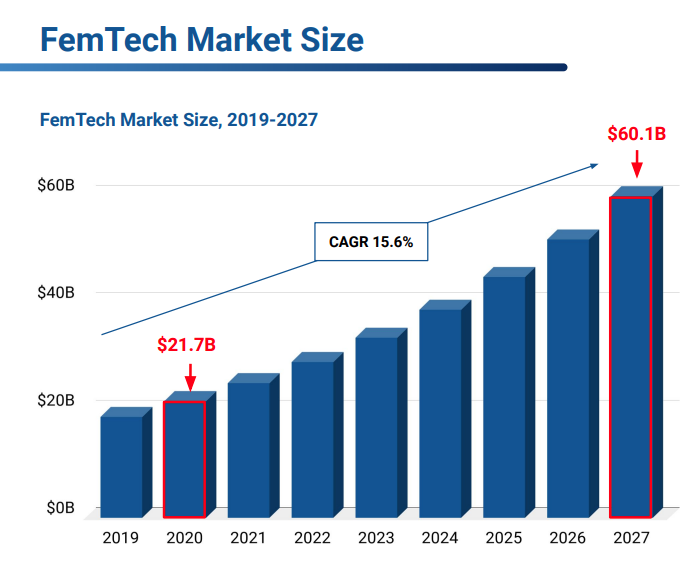

According to Dealroom, there are currently 382 startups around the world devoting to improving women's health and wellbeing, almost twice last year’s figure. This boom reveals the youthfulness of a market that, if forecasts are right, will achieve an annual growth rate of 16%, which will allow it to reach a value of $60 billion by 2027.

Source: FemTech-Industry-2021-Report.pdf (dkv.global)

“Femtech is still in its early phases, and just like all markets it has to become known and carve a niche for itself in the entrepreneurial sector,” says Maria Barruezo, co-founder of LactApp, one of the first femtechs in the BioRegion. An industry with such potential is not surprising to women entrepreneurs, bearing in mind the huge market niche that it targets.

“We're talking about solutions that address all the stages in a woman's life at all levels”, says Olga Shirokova, founder and CEO of Kiara, the online women's health academy that already has more than 40,000 users. From her vantage point, there are two key trends related to the rise in femtech: COVID and feminism. We all witnessed how the world came to a standstill last year, and in terms of digital health, innovation accelerated in a matter of weeks. “Plus, with the constant wave of female empowerment, women are increasingly sharing their problems and have realized that there aren’t many solutions tailored to their needs,” she explains.

Other factors that are feeding and driving the market growth are the increase in the adoption of healthy living habits and the introduction of new drugs for women. “In addition to favorable policies launched by governments, with awareness-raising programs and campaigns on the diseases that affect women,” adds Marina Rigau of MiMARK.

The challenge of investment

Recent months have witnessed substantial investments in American femtechs that brought the potential of this market into clear focus. They include Tia Health, founded in 2017, which raised $132 million in September of this year, and Maven Clinic Co (2014), which one month earlier, in August, received a capital injection of $100 million. This trend is reflected this year, too, in which global investment in the market has doubled the total in 2020: €2.1 billion (higher than the €1 billion from last year), according to figures from Dealroom. In the European market, 2019 was the year when femtech companies raised the most investments, with €304 million, driven by a round of €150 million. The United States heads the list of regions with the most investment in the world, with 55% of funding, ahead of Europe (25%) and Asia (14%), as shown in the latest report in the sector.

Despite their quick growth and the increasing interest they are prompting in investors, funding is still one of the main obstacles these solutions are facing. The figures from Crunchbase show that in 2020 only 2.3% of global venture capital funding went to startups led by women, and it is often difficult to secure funding. One of the most common cases in the funding deficit is the lack of empathy aroused by women's problems in a sector where the majority of professional investors are men. Yet there are other factors that condition investment in a project: “Many opportunities are niche, easily replicable or overly dependent on fashions,” says Sara Secall of Inveready, the fund that, however, saw clear potential in Oxolife, the femtech in the BioRegion devoted to women's fertility, in which it invested in 2020.

However, Aline Noizet, founder of Digital Health Connector, thinks that things are changing and that investors –especially male ones– are showing more and more interest. “At least they are curious and are making an effort to understand the world of women’s health,” she clarifies. One example was the investment fund Nauta Capital, which two years ago invested in Emjoy, the BioRegion startup that normalizes female pleasure and helps women enjoy their sexuality through audios created by professional sexologists. In the opinion of investor Xevi Fuyà, the investment community will begin to take serious notice of this market when the initial investments generate significant returns. “It will be achieved with patience and time. It's an industry with a bright future whose importance and clout will continue to grow,” he predicts.

Investment funds and specialized accelerators: A possible solution?

Meantime, to deal with this situation, the catalysts behind femtechs see investment funds specialized in women's health as an opportunity to attract funding. “Women's health should compete with other areas that tend to gain more interest from investors. We have to find funds specializing in women's health. There aren't many of them, but they do exist,” says Agnès Arbat, founder and CEO of Oxolife. Venture capital managers like Astarte Ventures (United States), Avestria Ventures Management (United States), Crowberry Capital (Iceland), Female Founders Fund (United States), Portfolia (United States), Rhia Ventures (United States), SteelSky Ventures (United States) and The Case for Her (Sweden) invest exclusively in femtech. “Those that are already investing in femtech are betting on a real capacity for disruption, which enables them to enjoy a privileged position in the sector,” says Maria Barruezo from LactApp.

Even though they are just starting out, there are some accelerators that promote disruptive technologies and new businesses for women's health, like FemTech Lab (London), FemTech Programa t Station F (Paris) and EVE FemTech Hub (Tel Aviv). This year the BioRegion has created HoMu Health Ventures, the first incubator in Spain for reproductive health projects.

The BioRegion: Third-ranked European hub in number of femtech startups

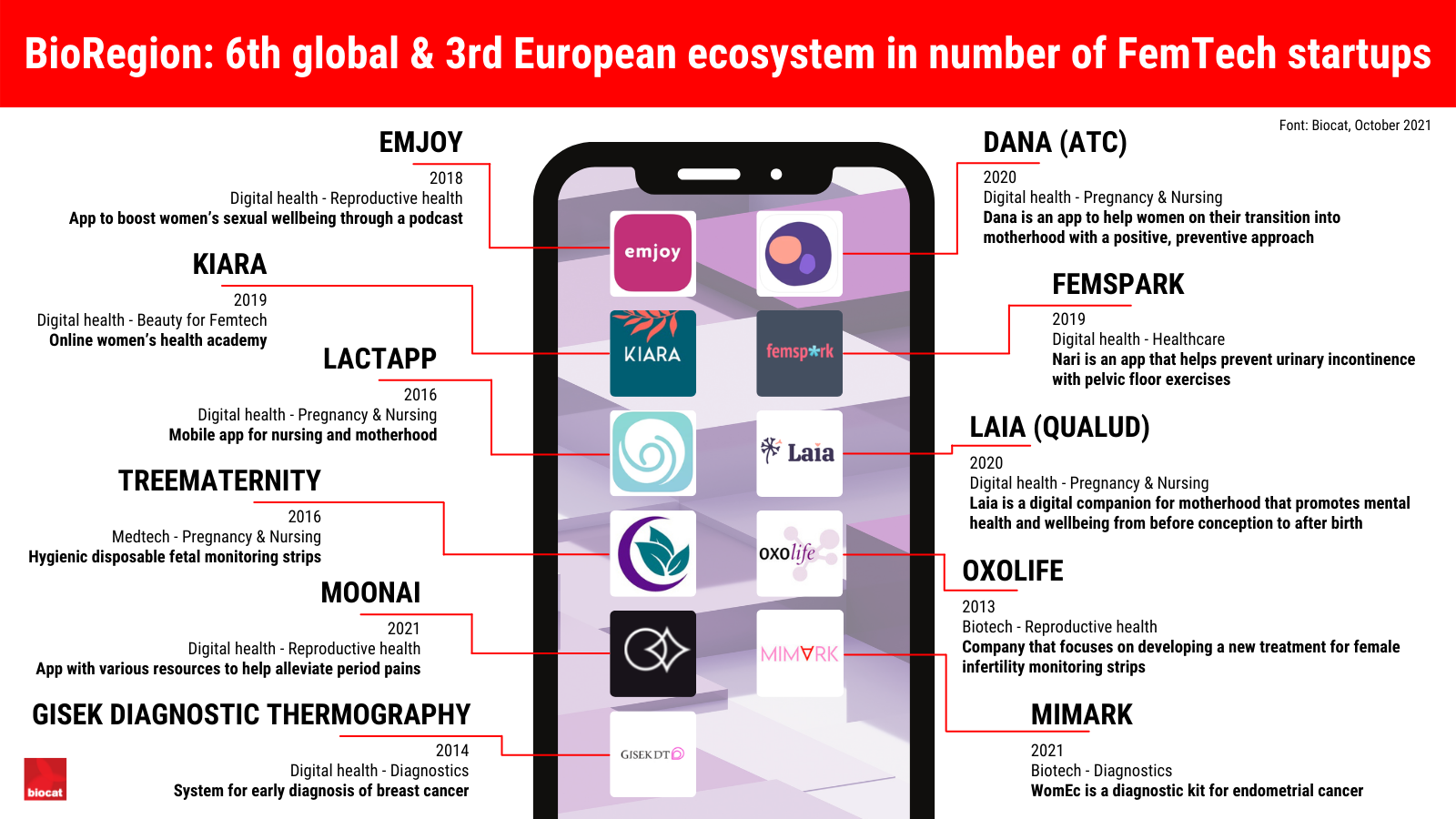

Currently, the Catalan ecosystem has 11 femtechs: Dana (ATC), Emjoy, FemsPark, Gisek Diagnostic Thermography, Kiara, LactApp, Laia (Qualud), MiMARKk, Moonai, Oxolife and Treematernity. This figure places the BioRegion in sixth place globally in number of women's health startups, only behind the United States (137), the United Kingdom (41), Israel (27), Germany (25), France (16) and Spain (16). If we look at this last figure, the BioRegion is the home to a full 69% of femtechs in Spain. Catalonia is also the third most important ecosystem in Europe in startups for women's health. Seventy-three percent are digital health, and most of them offer a product or service related to pregnancy or reproductive health.

In 2013, Oxolife was founded, the first femtech in the BioRegion, which raised €5.1 million the year it was created. The funding of these startups did not become steady until 2017, and they reached their historical peak in 2020. That year, the pandemic accelerated this market and €7.64 million was raised, seven times more than in 2019, primarily driven by private capital (84%). This figure accounted for more than 10% of European femtech funding, estimated at €60 million.

Source: Femtech investment in the BioRegion, 2017-2021. Compiled internally.

However, the upswing we have seen this year in the United States and Europe is not comparable to Catalonia. So far in 2021, we have not yet managed to surpass the 2020 figure, and unlike previous years, public funding exceeds private capital due to the grant that MiMARK received from the European Union.

In this context, women entrepreneurs claim that a lot remains to be done in the Catalan ecosystem. The market has to solidify, and especially encourage the birth and promotion of new initiatives, as well as secure specific funding programs that drive the development of these technologies. “This market should be seen as an opportunity. As an open door that had been wrongly closed for a long time,” says Marina Rigau.