2022, a historic year for the BioRegion

The 2022 BioRegion of Catalonia Report, promoted by Biocat since 2009 and presented this month in front of over 600 people in Barcelona, shows a sector that is sustainably growing and beating historic records in funding for startups and scaleups, M&A operations, investors, and international capital investment, as well as offering excellent indicators in clinical trials and scientific publications.

In a year of uncertainty due to the generalised decrease in investment and prices in global markets, the BioRegion of Catalonia has seen record figures in economic and innovation indicators, as can be seen throughout the five chapters of the 2022 BioRegion of Catalonia Report. A year in which the sector continued to generate wealth for the country with an industry that exports over 53% of all Spanish life sciences and healthcare products, placing Catalonia first regarding exports of life sciences and healthcare products in Spain, a business network that includes more than 1,350 companies and that employs 247,000 people (7% of the employed population in Catalonia). In addition to this, a growing segment of startups and scaleups that have broken historic records in funding. These indicators strengthen the BioRegion’s position as one of the most dynamic health innovation hubs in Europe and the first in Spain, with the constant arrival of international and multinational innovation centres.

Record funding and the first megaround in history

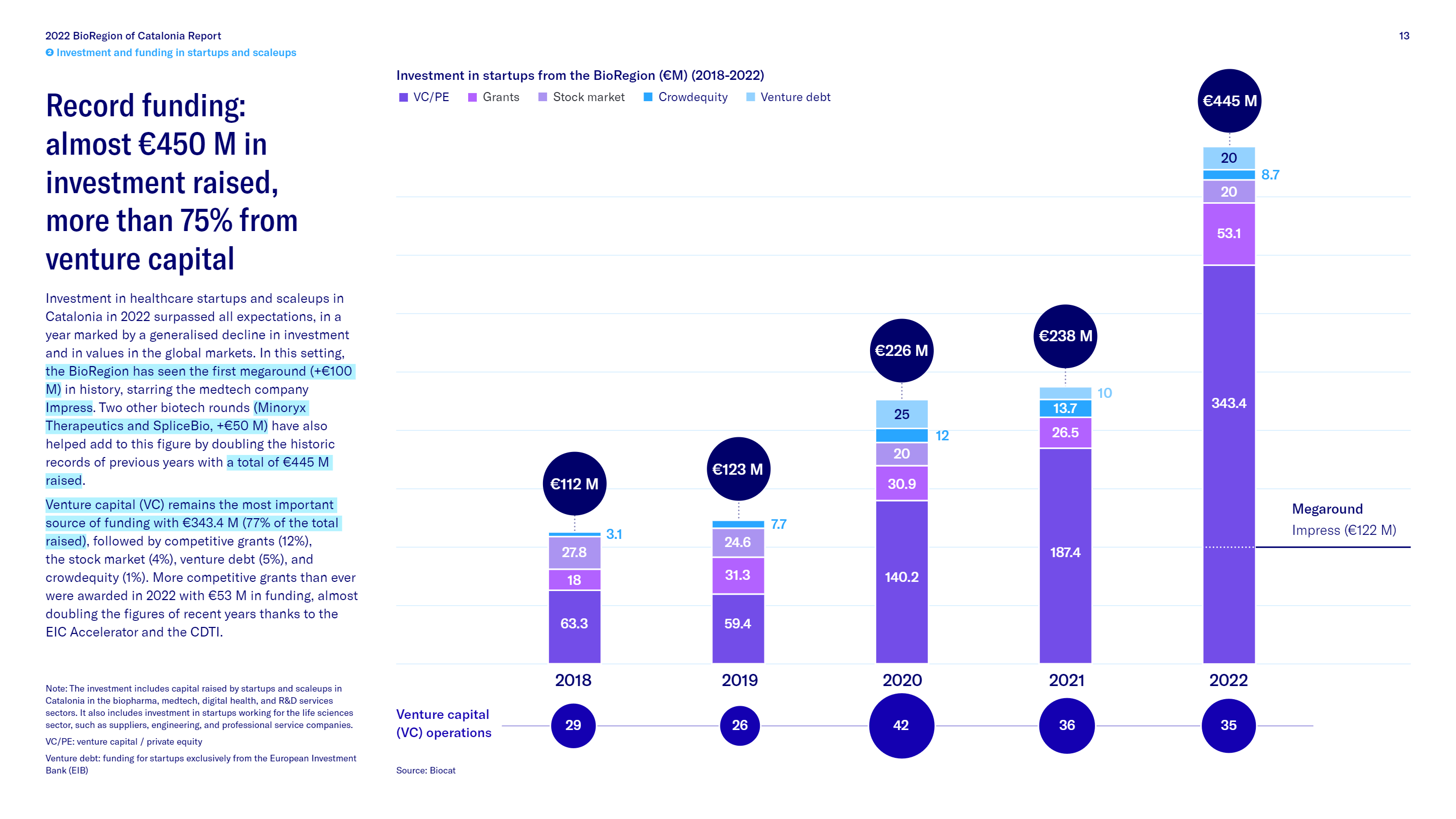

In 2022, the BioRegion’s startups and scaleups rose 445 million euros in investment, the highest figure recorded to date and primarily from venture capital, which totalled 343 million euros and accounted for 77% of total capital raised in 35 operations. As can be seen in the figure, investment was promoted by the first megaround in the history of the BioRegion, in which 122 million euros was raised by the dental health medtech Impress. Despite this, were this exceptional operation to be excluded, the total funding raised (323 million euros) would also have increased significantly in comparison with the investment volume of the previous year (238 million euros).

Foreign investment continued to beat record figures. 95% of all capital raised involved international investor companies. Along these lines, the number of international investment funds that have historically taken part in operations reached 117, a figure that has doubled over the past three years.

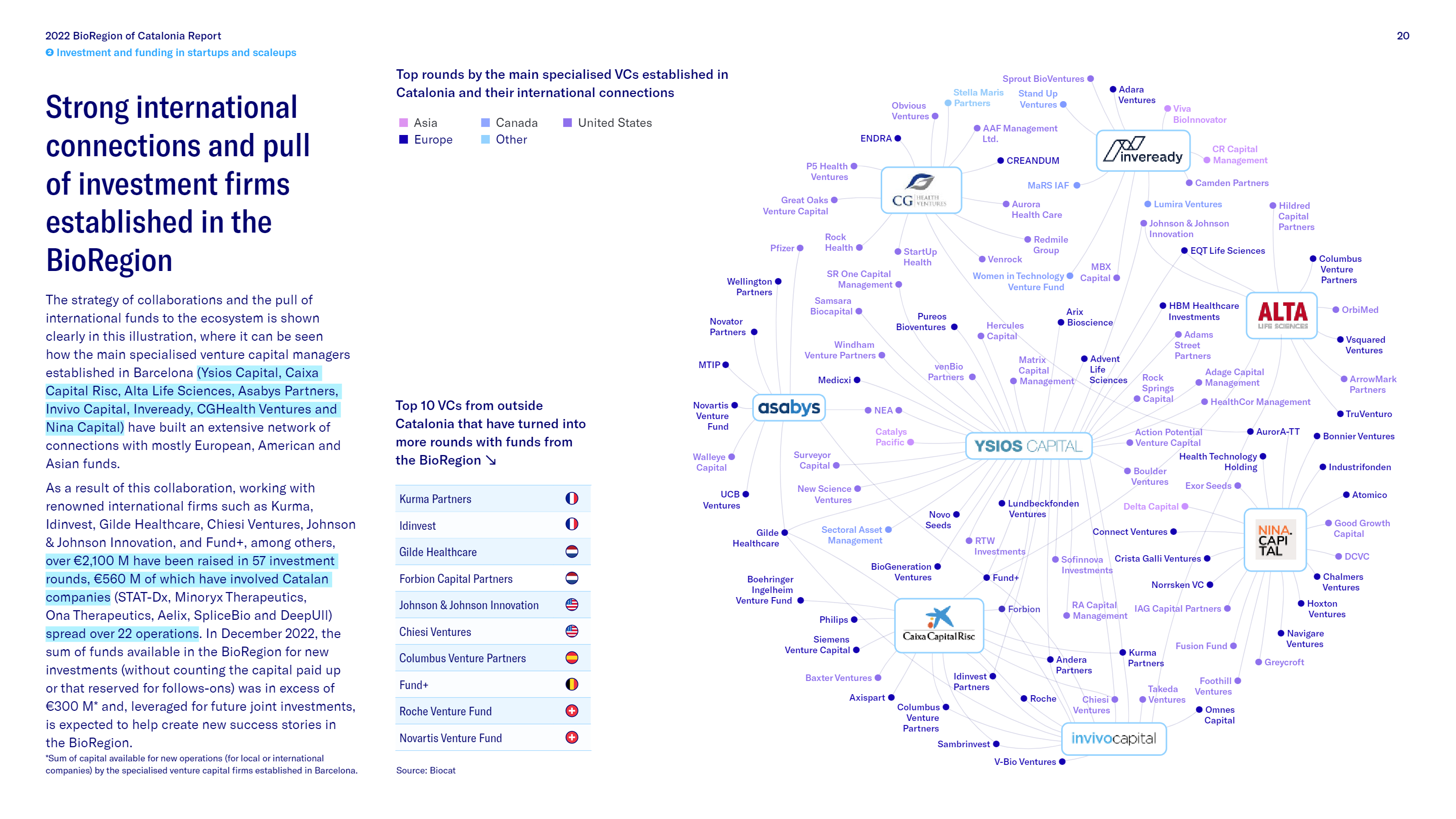

The support of the main specialised venture capital funds established in Catalonia, such as Ysios Capital, Alta Life Sciences, Asabys Partners, Invivo Capital, Inveready, Caixa Capital Risc, CG Health Ventures, and Nina Capital, has become key to the success of these operations. All in all, 11 operations of the 20 involving international capital were not syndicated with local investor companies.

It must be noted that the second source of funding after private capital involved competitive grants (12% of the total), which reached the best figure in all history with the sum of 53 million euros in funding, almost doubling the figures obtained over previous years, primarily due to the European Innovation Council (EIC Accelerator) and the Centre per al Desenvolupament Tecnològic Industrial (Centre for Industrial Technological Development - CDTI). This was followed by the stock market (4%), venture debt (5%) and crowdequity (1%).

Upturn of biotech companies

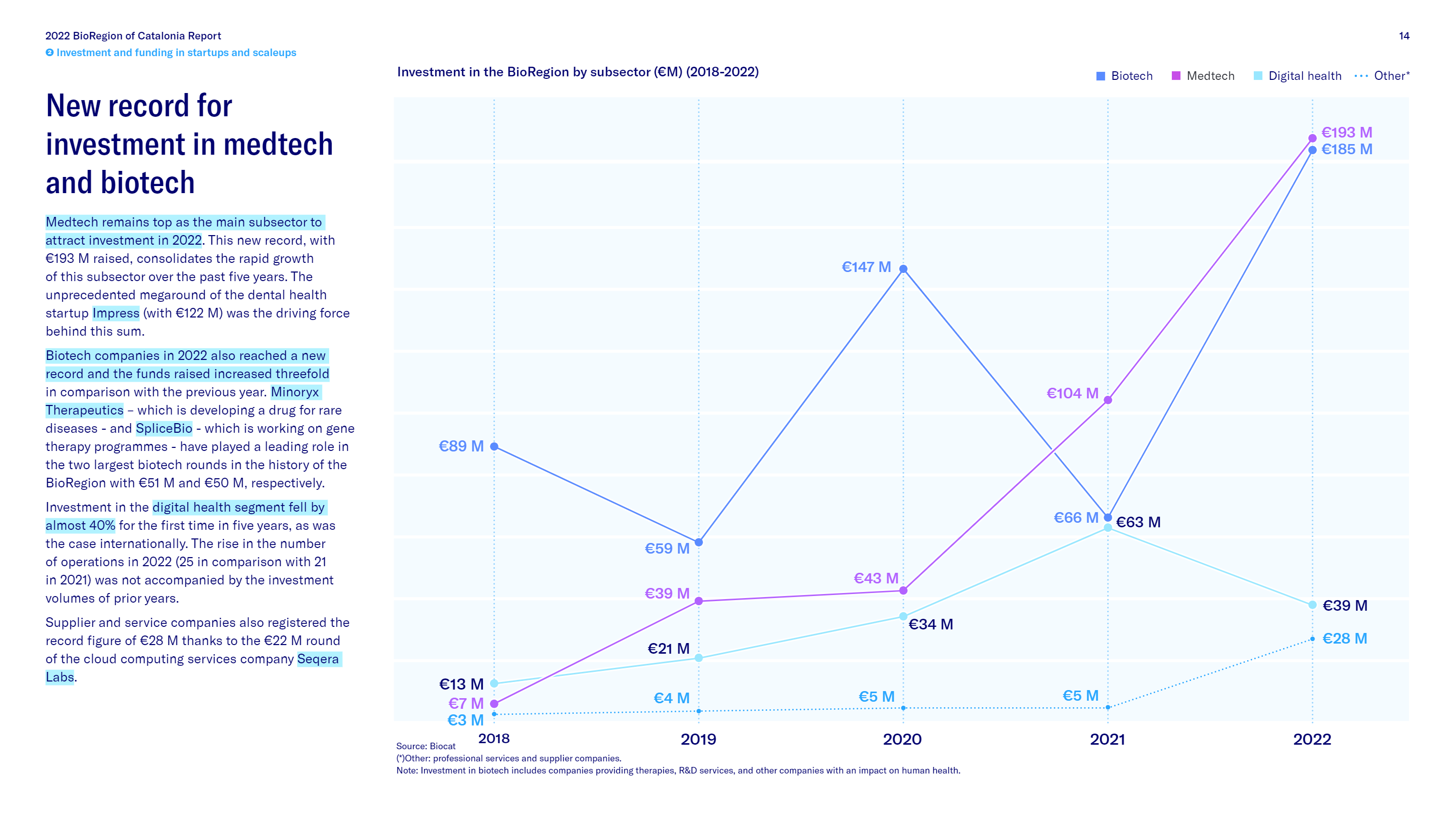

In terms of investment trends, medical technologies were the main subsector in raising investment for the second year running with 193 million euros, mostly due to the 122 million-euro megaround by Impress mentioned above. Despite this, there has been a new upturn in biotech companies that have also reached a new record with 185 million euros, a threefold increase in the funds raised the previous year (66 million euros in 2021). This increase was primarily due to two record venture capital operations, the largest two biotech rounds in the history of the BioRegion and of Spain: the 51 million euros of Minoryx Therapeutics and the 50 million euros of SpliceBio.

With 39 million euros in investment, the digital health segment fell by almost 40% in comparison with 2021 for the first time in five years, as was the case in the international arena. However, with 212 startups and the creation of an average 20 new digital health startups a year in Catalonia, it is the fastest growing subsector despite being the youngest (95% of all companies were established over the past ten years).

Excellent indicators in research: clinical trials, scientific publications, and competitive funds

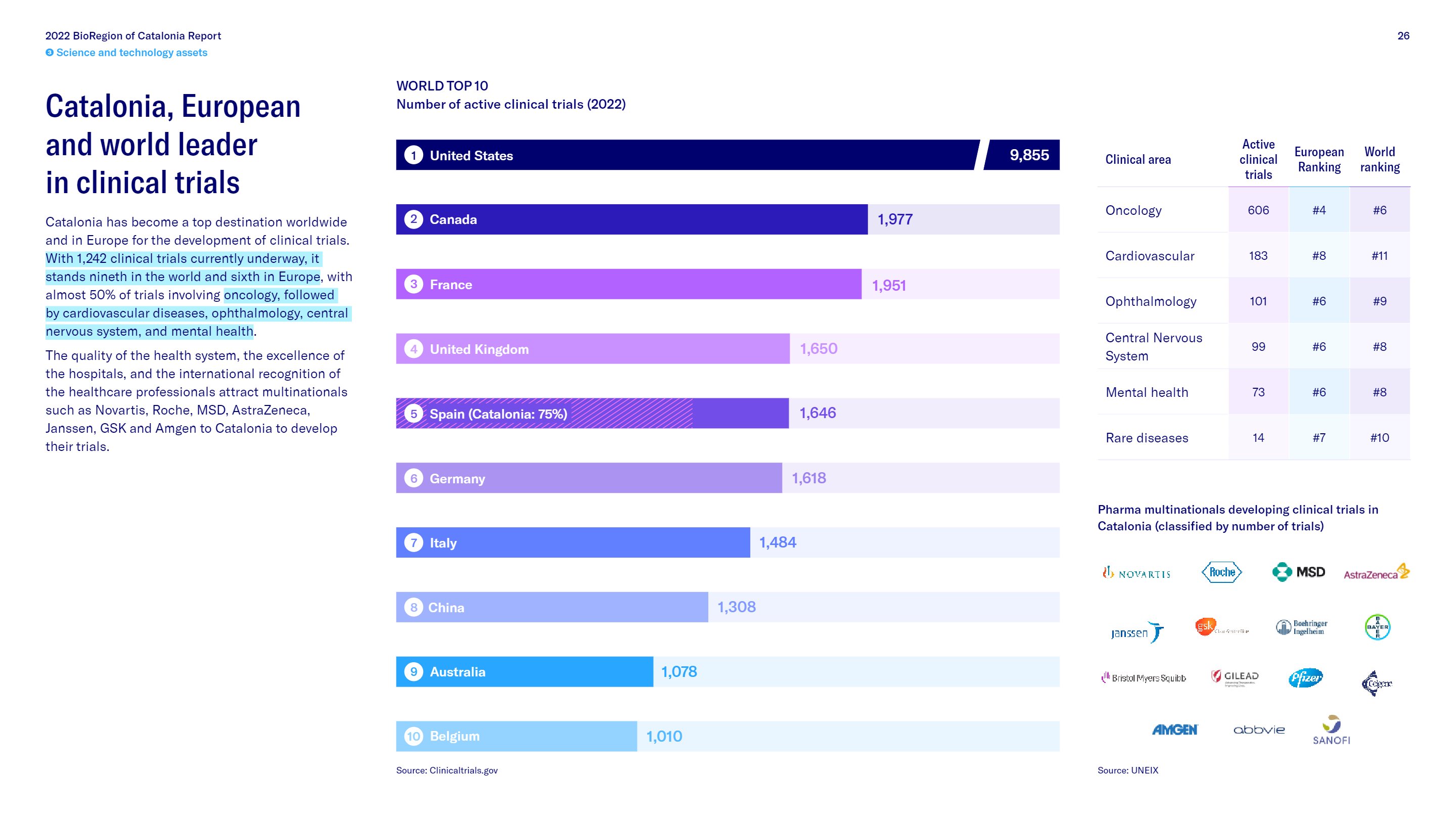

Catalonia has become a top destination worldwide and in Europe for the development of clinical trials. With over 1,200 active clinical trials, the BioRegion is 6th in Europe, only behind France, the United Kingdom, Spain -Catalan centres take part in 75% of the active clinical trials held throughout Spain-, Germany and Italy. Worldwide, Catalan stands 9th, with the United States and Canada holding the top two positions. In terms of clinical areas, over 50% of clinical trials involve oncology, followed in number of studies by cardiovascular diseases, ophthalmology, the central nervous system, mental health, and minority diseases.

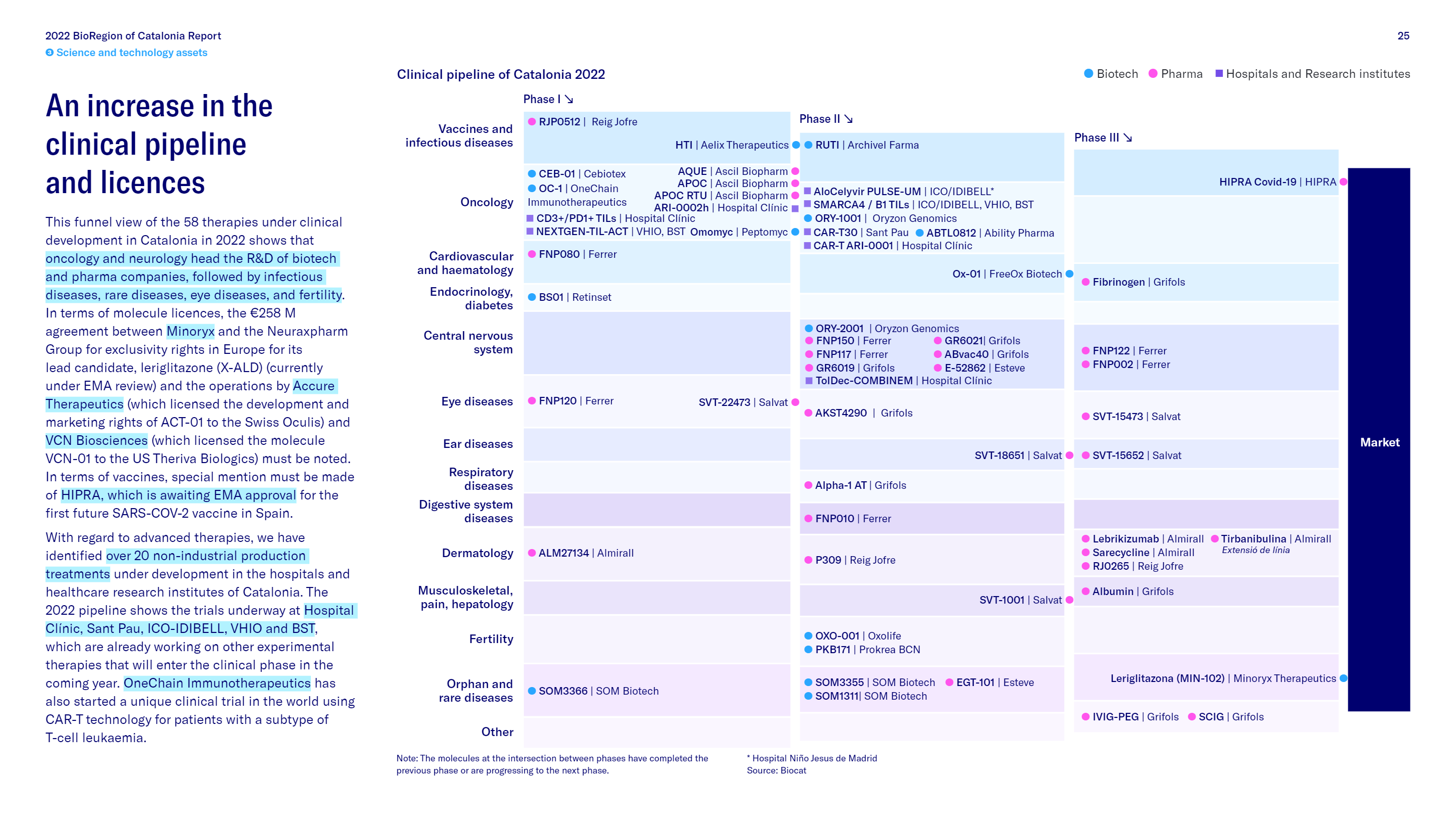

The time frame in which research and new therapies will have an impact on patients is shown through the BioRegion’s pipeline, with a total of 58 therapies being developed and a wide variety of clinical areas (primarily in oncology, neurology, infectious and minority diseases), some of which are close to being commercialised and reaching the general public. The pipeline includes some off the advanced therapies being developed at Hospital Clínic, Hospital de la Santa Creu i Sant Pau, ICO-IDIBELL, VHIO-Hospital Universitari de la Vall d’Hebron, and Banc de Sang i Teixits.

Insofar as scientific publications and the attracting of competitive funds, Catalonia is among the top five (per million inhabitants) in Europe in terms of the number of publications, attracting of H2020 funds, and in the number of European Research Council (ERC) grants, all indicators that show the quality of the research and the leading role of Catalonia in the biomedical sector

The macroeconomic context continues to err on the side of caution yet with certain optimism

The decrease in prices, operations and stock market activity in the sector worldwide, along with rising inflation and interest rates in 2022, makes it difficult to forecast the scenario for this 2023.

We wanted to find out first hand what the specialised investment funds of the BioRegion thought and what their forecast would be for this year: “The macroeconomic context remains complex due to rising inflation and the increase in interest rates. If this situation continues, there will most likely be a recession, as is the case internationally, but it is important to maintain investment to build on the great progress made over the past decade”, indicates Jordi Xiol, a partner at Ysios Capital. Lluís Pareras, a founding partner of Invivo Capital agrees with this, “everything points to interest rates remaining high for a while, but I am rather optimistic because the speed of the global economic problem is slowing down”.

Montserrat Vendrell, a partner at Alta Partners, also indicates that “the overall feeling is that prices are correcting themselves slightly”, an impression that is also shared by Guillem Masferrer, a partner at Assabys, who adds that “the family office has raised fewer dividends and, therefore, lower investment capacity, which is also the case in the institutional realm”. In terms of crowdequity, Daniel Oliver, director of Capital Cell states that “private investors are seemingly more timid, and this leads to a drop in prices and, potentially, higher future profits for active investors".

Here’s a positive forecast for 2023, although still erring on the side of caution: “With regard to capitalisation, there's a lot of money in venture capital and, therefore, there won’t be any problems in investing. But investment funds will be more cautious due to the international uncertainty”, says Pablo Cironi, Life Sciences Investment Funds director at Caixa Capital Risc. Moreover, Sara Secall, a general partner at Inveready, admits that “private biotech investments are a well established market long term and, therefore, we are expecting growth to remain at pre-pandemic levels”.

This post looks over only some of the economic and innovation indicators of the 2022 edition, which this year includes the collaboration of ACCIÓ, the associations CataloniaBio & HealthTech, Farmaindustria, and Fenin, and the companies Amgen, ESTEVE, Almirall, and Alira Health.

If you want to find out about all the conclusions of the state of the sector (in investment, research assets, technology transfer, ecosystem initiatives, recommendations to improve equality in the sector, and the challenges of the industry, among others), please read the Report and watch the BioRegion 2022 video.