Four key steps to define your market access strategy before entering new markets

Market access and pricing (MA&P) is an increasingly key piece to a successful product development and launch strategy. Let us explore why MA&P is so essential, what is the right timing for incorporating it into your overall strategy, and how to manage market access after launch.

Why is MA&P so important?

Over the last 10 years, healthcare systems have seen increased pressure on their budgets, a trend toward greater transparency, and the introduction of increasingly complex and expensive technologies in the market. As a result, health authorities continue to incorporate new regulations and controls to evaluate and cover them, and to improve efficiency while closely monitoring health expenditure.

These elements have made MA&P essential to overall product development. So much so that today, MA&P departments are common within life sciences organizations, particularly in large companies. Even if MA&P is not a formal department, they are usually integrated within the business units or fall under governmental or public affairs.

Even with more presence of MA&P in companies, to really maximize pricing and access conditions, all the actions and activities within MA&P must be carefully planned and developed early to avoid:

- Mistakes in product positioning and characterization

- Evidence gaps or wrong study designs (clinical, social, economic)

- Unexpected costs with the need of new studies or adapting the launching strategy

- Lower results than expected, including P&R conditions and revenues

When does MA&P strategy need to be defined?

Defining the MA&P strategy at an early stage—Phase I-II for medicines and prototyping/testing for MedTech—is key. Market opportunity for a specific product can be optimized by:

- Informing the clinical plan with market specifics that consider country-specific clinical development needs, and adapting clinical trial design and other studies to be developed (including HEOR and/or RWE studies) from payer, physician, and patient perspectives

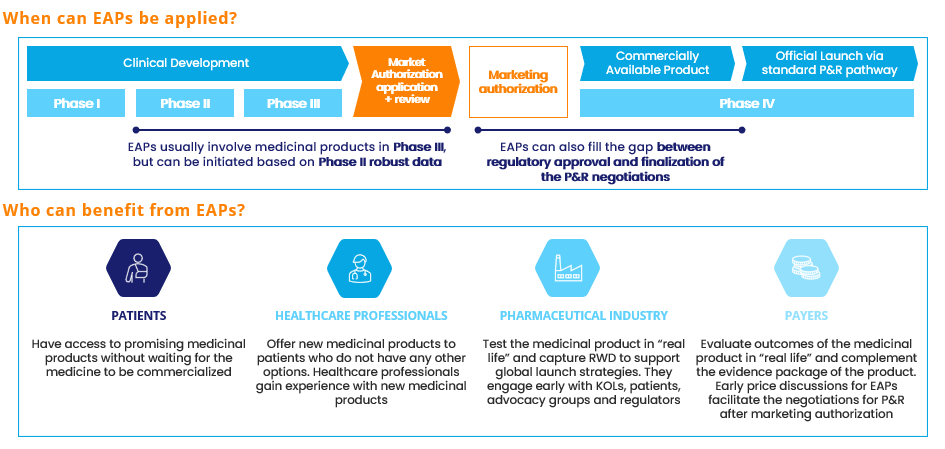

- Planning an early launch by implementing either Early Access Programs (EAPs) for pharmaceutical products or public innovative funding for MedTech

- Having a robust business case with supporting evidence that includes: testing assumptions with key stakeholders, considering different scenarios on target population and P&R conditions, and a list of red flags to carefully monitor

Figure 1. Early Access Programs (EAPs) overview . Source: Alira Health

What are the key steps for MA&P within the development lifecycle?

While early assessment is the first step for MA&P, there is additional work throughout the product development lifecycle. Called late-stage market access, the next steps start during Phase II-III for medicines and validation for MedTech given the amount of work required.

Establish a good understanding of the market and the healthcare system

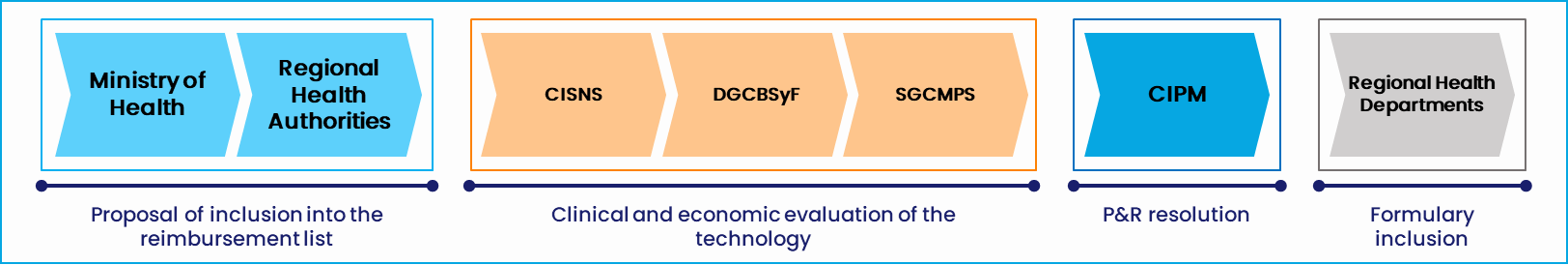

This includes the type of health care provided, its organization and expenditure, the possible commercial and dispensation channels, the specific regulations, and main bodies. It’s also necessary to have a deep understanding of the access pathways—the different Health Technology Assessment (HTA) and pricing and reimbursement (P&R) negotiation processes, the level of evidence required, the key decision-drivers, and pricing mechanisms. Both HTA and P&R processes are key for market access:

- Health Technology Assessment (HTA): Systematic assessment of the properties and effects of technology, comparing the added benefit over existing alternatives. This is always done from a clinical perspective, but in some countries, it also includes an economic assessment

- Pricing and reimbursement (P&R) negotiations: Negotiations regarding public reimbursement, the price to be paid (gross and net prices when applicable), and the implementation of innovative contracting, including financial and performance-based agreementsd’una contractació innovadora, inclosos els acords financers i basats en el rendiment.

Figure 2. High-level HTA and P&R process in Spain. Source: Alira Health

Related to access pathways, detailed stakeholder mapping is crucial to targeting each market appropriately and with an understanding of the relevance and roles in the decision process of different HTA and P&R bodies, KOLs, and patient representatives. For other activities such as clinical engagement and commercial structure, mapping the reference hospitals and KOLs, hospital/retail pharmacists, and patient associations may also be needed, depending on the disease.

In parallel, developing proper market sizing illustrates the real size of the opportunity, the current market landscape and pipeline (potential future therapies entering the market), and market shares. This informs the business case by providing data inputs for different forecast scenarios. Together with quantitative sizing, qualitative market research is key to understand the national (and regional) health plans for the disease, value of the product compared to other treatment alternatives, product positioning, and prescription and administration behaviors.

Test the payer message and anticipate their objections

Once the value proposition from the medical perspective is defined, the next step is to adapt it for a payer perspective by testing the payer messages and anticipating their objections. This research is also aimed at validating the assumptions on the access pathway and key decision-drivers, assessing their perception of clinical unmet needs and burden of disease, and testing the Target Product Profile (TPP) to get an accurate estimate of pricing conditions and access restrictions.

Testing and validating all topics from the patient perspective is important. Too often the patient voice is neglected, but the market is moving towards a patient-centric vision.

Develop value package and economic models

After all the assumptions and value messages have been validated, the development of the value package and economic models can be started—even before the final clinical results are available. The value package includes the value dossier with the clinical (efficacy and safety) and social (QoL and economic impact) evidence to be submitted to national agencies, as well as any other relevant materials. The economic models can be either a budget impact or a cost-effectiveness model, depending on each market.

Conduct P&R negotiations

After submitting the evidence to authorities, the last step before entering the market is P&R negotiation. With appropriate material preparation and market investigation, good negotiating planning and negotiation partners, the negotiations should be straightforward with no unforeseen challenges or setbacks.

What happens after entering the market?

With a strong MA&P strategy, your product will have a successful launch. However, market access does not end with your product launch. Operational activities need to be developed while the product is commercialized. These activities all require their own strategies for success and include generation of RWE, re-negotiations and evidence and pricing reviews, implementation of managed entry agreements, competition and loss of exclusivity management, and parallel trade mitigation.

Choosing the right partner for your MA&P strategy is essential to market entry and all the post-launch activities required. Alira Health’s in-depth experience and cross-functional approach can guide you during all phases of product development. You can learn more about Alira Health’s expertise by reaching out to its expert team at info@alirahealth.com or visiting the website www.alirahealth.com.

List of abbreviations:

- CIPM: Interministerial Medicinal Products Pricing Committee

- CISNS: Inter-territorial Council for the Spanish National Health System

- DGCBSyF: General Direction of Basic Health Services and Pharmacy

- EAP: Early access program

- HEOR: Health economics and outcomes research

- KOL: Key opinion leader

- P&R: Pricing and reimbursement

- QoL: Quality of life

- RWE: Real-world evidence

- SGCMPS: Sub-directorate of Quality of Drugs and Medical Devices

- TPP: Target product profile

This article is written by Chus Castillo and Marc Manau, Director Global and Senior Consultant Market Access & Pricing at Alira Health, a key contributor to the BioRegion Report 2021. Read the full chapter on Market Access Strategy”.