2023: all healthcare innovation indicators up, except venture capital

Indicators like exports of products from the sector, foreign direct investment, investment in startups, number of publications and participation in clinical trials are up, keeping Catalonia among the most competitive healthcare innovation hubs in Europe despite the drop in venture capital, mainly from international sources. This data is from the 2023 BioRegion of Catalonia Report presented on February 12 in Barcelona to over 700 professionals from the sector.

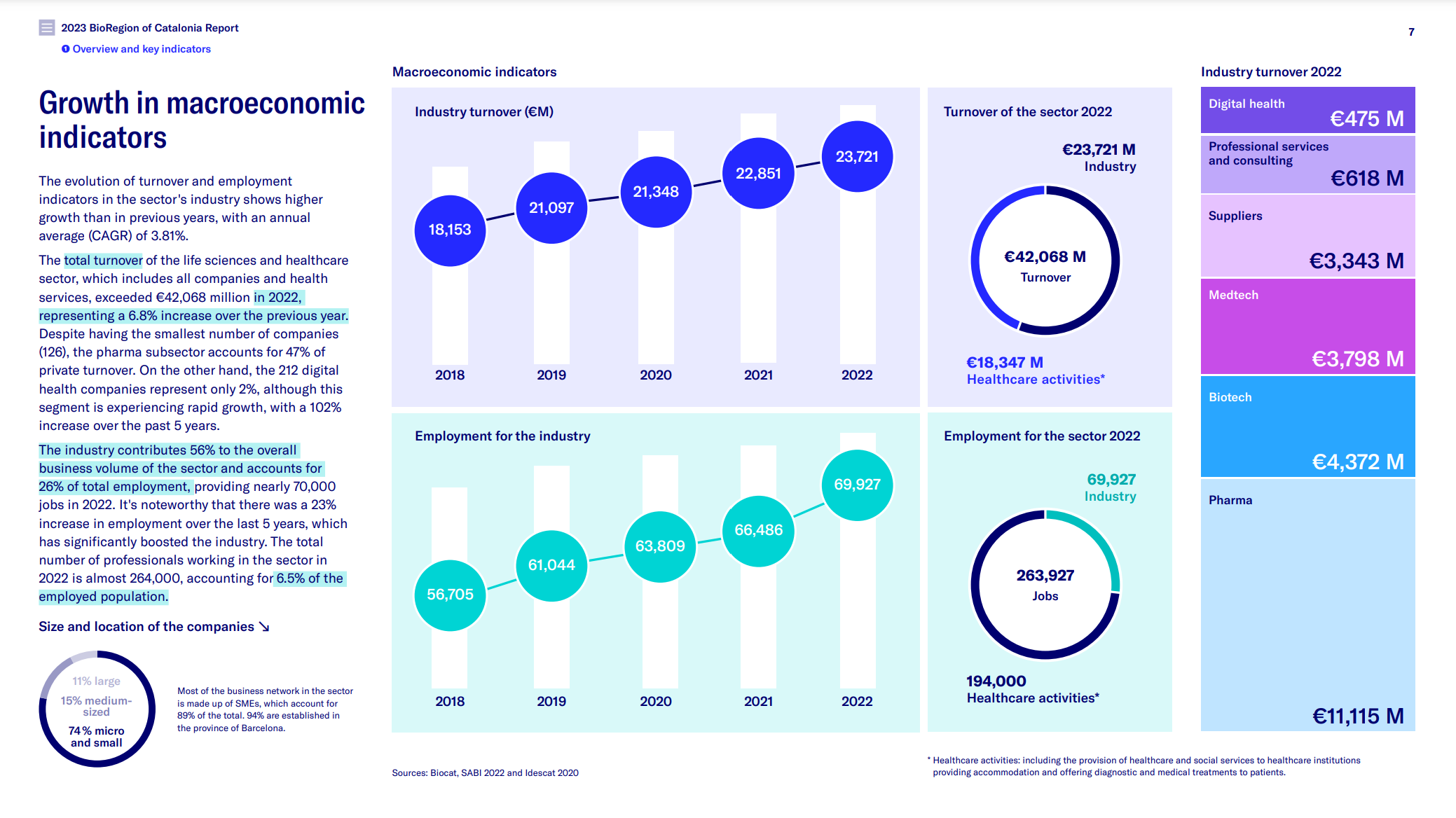

Although 2023 wasn’t a record year in terms of investment in startups and scaleups in Catalonia like 2022, with its three exceptionally large rounds, the sector has continued growing, with healthcare innovation indicators rising. This can be seen in the 1,400 companies and 91 organizations that employ 264,000 people, 6.5% of the working population in Catalonia, and are located in Barcelona and its metropolitan area. They have a joint turnover of nearly €24 billion and export more than 30% of all life sciences and healthcare products from Spain.

“The sector continues growing and this can be seen in the healthcare innovation indicators in the Report, the many business and research initiatives from all the stakeholders, and also the strategic countrywide projects like the Innovation Adoption in Healthcare program and the Advanced and Emerging Therapies Network of Catalonia. These initiatives will drive the digital transformation, improve treatments and the ecosystem’s sustainability, and fuel the shift towards the personalized medicine of the future,” declared Biocat CEO Robert Fabregat.

This sector made up 7.9% of the Catalan GDP in 2022 and is constantly welcoming new international innovation centers and multinational corporations. In the past 5 years, 25 new hubs of excellence have been set up, including those by AstraZeneca and Alexion, which helped set new records in direct foreign investment in 2023 (€1.025 billion) and new jobs created (1,843).

“The BioRegion of Catalonia Report for this year shows the growing importance of the sector in the Catalan economy, and this is due to the top-notch science fabric we have been building for years among the biotechnology companies, public research centers, digital health companies, hospitals and science parks. Making Barcelona and the BioRegion one of the most important healthcare innovation hubs in Europe is one of the best commitments to our future that Catalonia can make,” noted Amgen Iberia General Manager Fina Lladós.

Global cutting-edge research

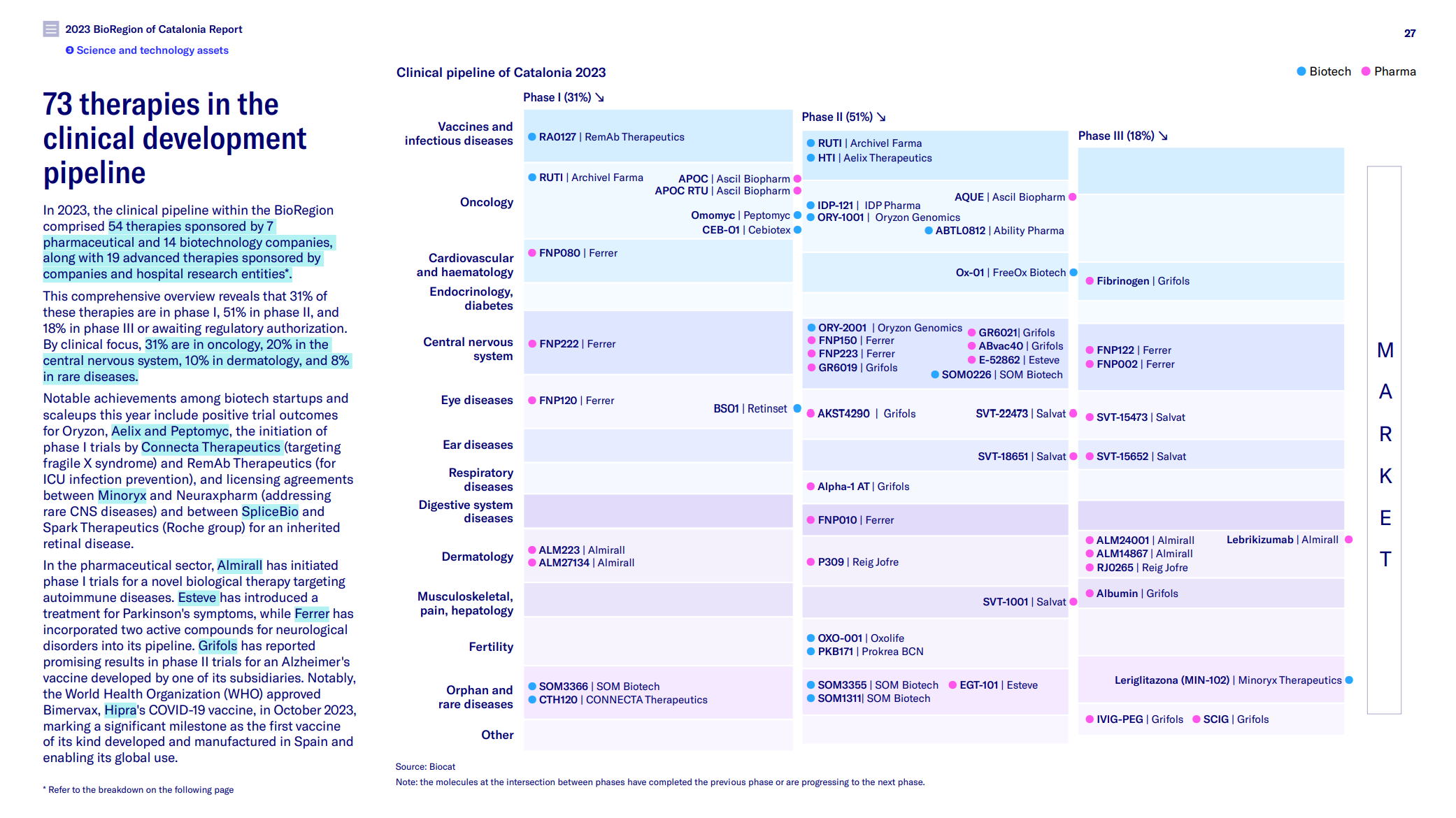

In 2023, the clinical pipeline also continued growing. The BioRegion has 54 therapies from 7 pharmaceutical companies and 14 biotechnology companies, and 19 advanced therapies from companies and research bodies. These stand out in a wide range of clinical specialties, led by oncology, the central nervous system and dermatology.

Some of the most noteworthy milestones of biotech firms include the positive trial results from Oryzon, Aelix and Peptomyc, the start of phase I trials at Connecta Therapeutics and RemAb Therapeutics, the licensing deals signed by Minoryx with Neuraxpharm and by SpliceBio with Spark Therapeutics (Roche group) for a drug to treat a hereditary retina disease.

In pharma, Almirall kicked off phase I on a biological drug to treat autoimmune diseases, Esteve started commercializing a treatment for Parkinson’s symptoms, Ferrer added two new CNS active ingredients to its pipeline, and Grifols published positive phase II results for an Alzheimer vaccine being developed by one of the companies in the group. Other highlights of 2023 include Bimervax, the COVID-19 vaccine from Hipra (the first of its type designed and manufactured in Spain), which in 2023 was granted WHO approval to be used around the world.

“It is clear that Barcelona is establishing itself as a European life sciences hub, attracting significant global investment in healthcare. We’re excited that our R&D center is helping fuel healthcare innovation in the Barcelona area,” says Marc Soriano, R&D Project, Portfolio and Partnership director at Almirall.

In terms of clinical trials, Catalonia is once again near the top of the global ranking (eighth in the world), which is led by the United States and China in the first two positions. In Europe, Catalonia is fifth, only surpassed by countries like France, Spain, Italy and the United Kingdom. In Spain as a whole, Catalan centers take part in 88.5% of all active trials. In terms of clinical areas, 34% of the clinical trials Catalan centers take part in are in oncology, where Catalonia is ranked fourth in Europe and seventh in the world.

“We celebrate the consolidation of activity in the BioRegion as it valorizes the efforts of the biotech sector to drive innovation, generate public-private synergies and attract and retain talent in Catalonia, among others. This work is essential to innovative biopharmaceutical companies like Sanofi, where we work to give patients innovative therapeutic solutions without forgetting our significant socioeconomic contribution, industrial activity, investment in R&D and social commitment,” noted Arantxa Catalán, head of Public Affairs at Sanofi Spain.

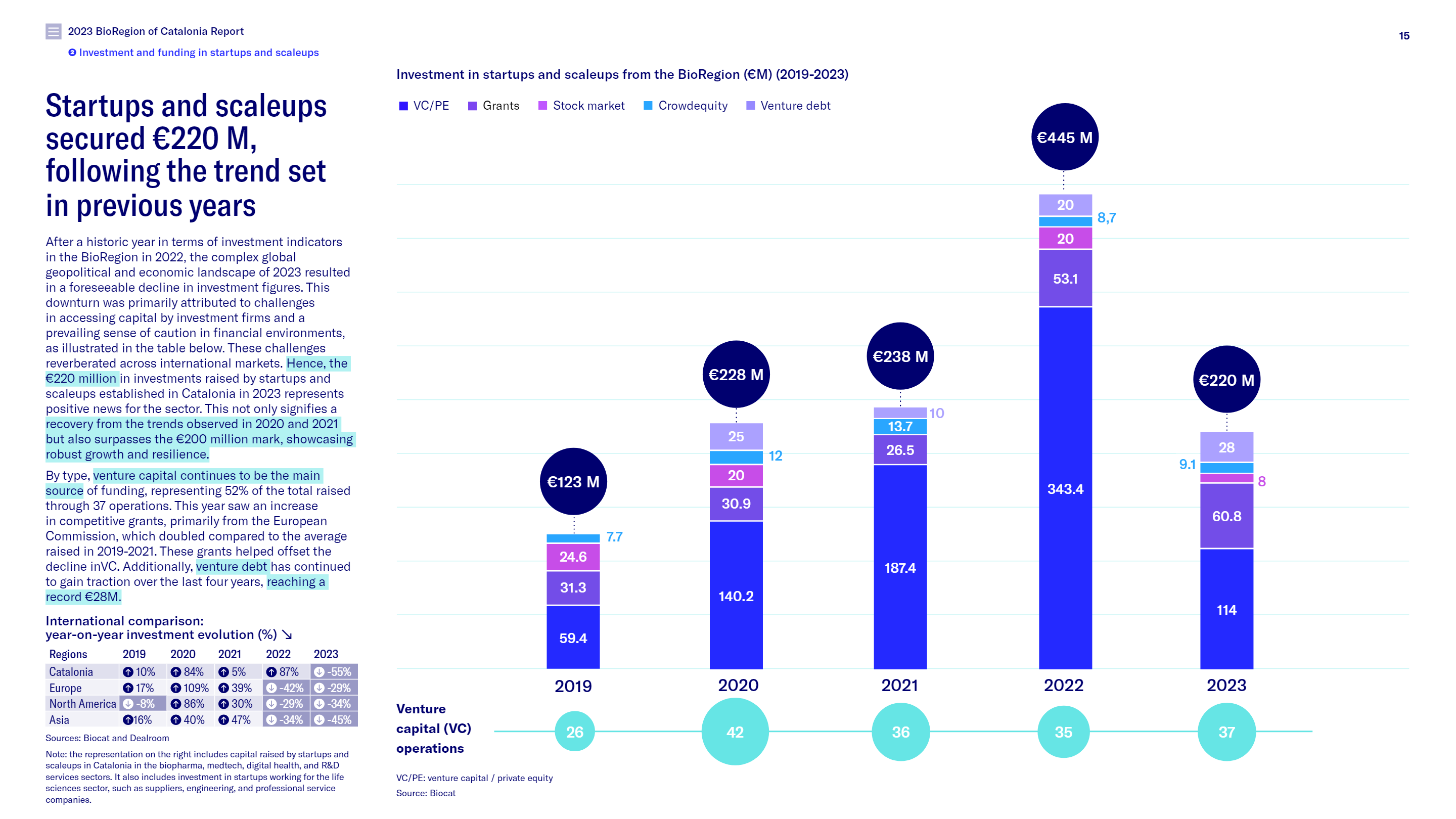

Entrepreneurial fabric resists cutbacks in investment globally

The Catalan entrepreneurial fabric in healthcare raised €220 million in 2023. That is 7.5% less than in 2021 and 3.6% less than 2020, considered benchmark years as 2022 was an extraordinary, historic year due to three large operations: Impress, Mynorix Therapeutics and SpliceBio, which secured a joint total of €445 million. So, in a year of drastic cutbacks in investment around the world, Catalan healthcare startups and scaleups held steady.

Venture capital remained the main source of investment with €114 million (52%). This figure is down from the previous year, mainly due to the cautiousness of financial environments in all international markets and the decrease in capital available, which made it more difficult to put together large investment operations and, as a result, to attract international investment. So much so that in 2023 in Catalonia 58% of all private capital secured included international investors.

The second biggest source of funding was competitive grants, which saw an all-time high of €60.8 million (27.5%), helping offset the drop in venture capital. Venture debt also hit a record high with €28 million (13%), followed by crowdequity (4%) and the stock market (3.5%).

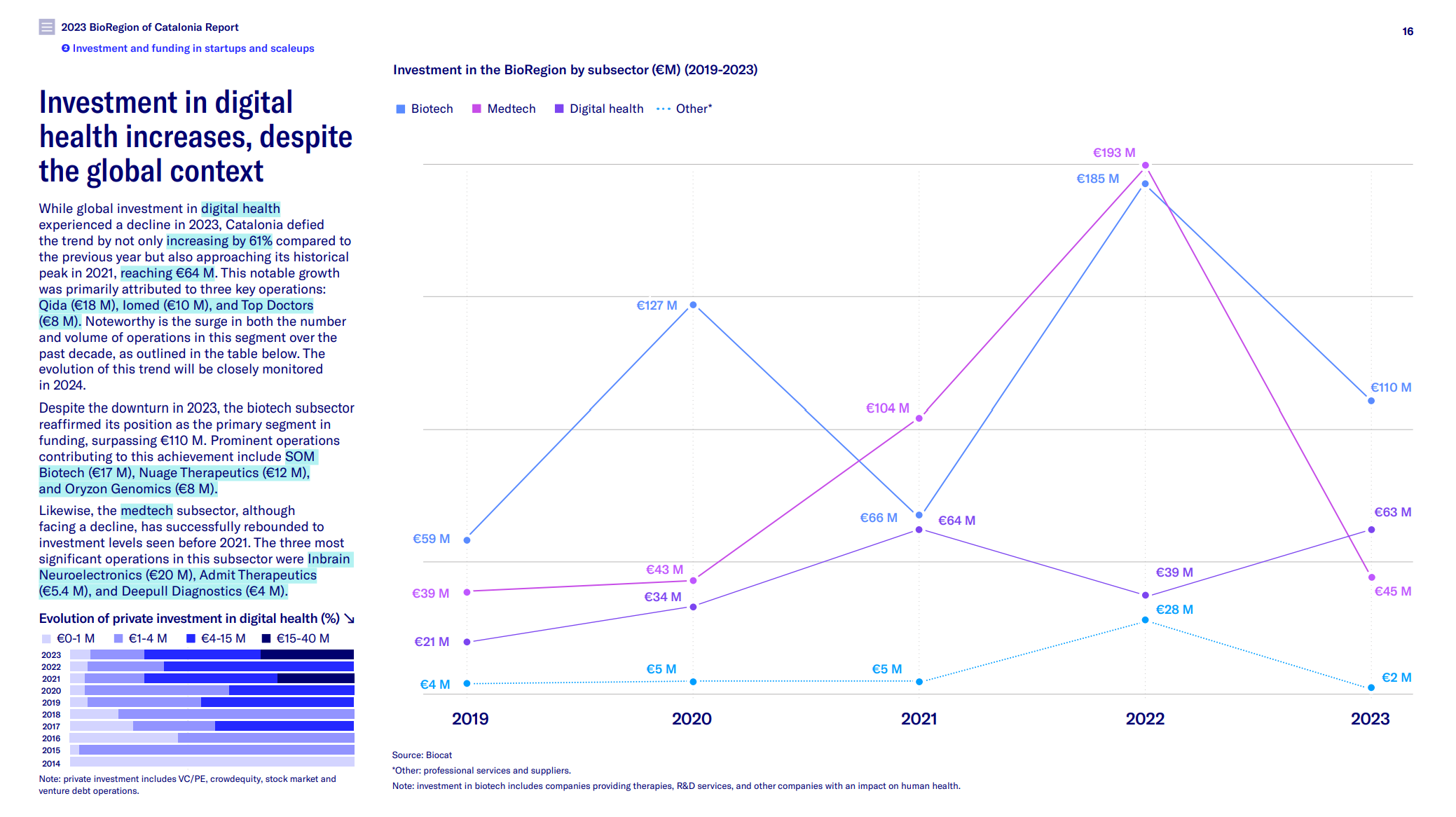

Looking at the trend in investment by subsector, the rebound in digital health companies was noteworthy, and at €63 million was close to the all-time high of €64 million in 2021. This compares favorably to other international markets, where investment dropped. Despite the decrease, biotechnology companies secured more investment than any other segment in 2023, with €110 million. The medical technology subsector attracted €45 million, holding steady at the 2020 level.

“The 2023 BioRegion of Catalonia Report provides a transversal, exhaustive view of the ecosystem in Catalonia. It is a great tool that invites us to reflect on what happened in 2023 and helps us anticipate the main drivers of the life sciences sector in 2024: advanced therapies and digital transformation,” explained Elena Cuatrecasas, partner at Cuatrecasas.

This article covered just some of the economic and innovation indicators in the 2023 report, which this year was made possible thanks to the support of Amgen, Almirall, AstraZeneca, Alira Health, Cuatrecasas, Esteve, Pfizer, Roche & Sanofi, and the collaboration of ACCIÓ, CataloniaBio & HealthTech, Farmaindustria & Fenin.

If you want to get all the conclusions regarding the state of the sector (in investment, research assets, technology transfer, ecosystem initiatives and more), check out the Report and the video on the main indicators from the document with images from some of the big names in the ecosystem.